Did you know that you can list charity groups as beneficiaries in your will? Here is what you need to know.

Why Leave Money to Charity?

Some people choose to leave money to a charity (or charities) of their choosing as a way of leaving a meaningful legacy and helping others after they are gone. You can make an impact on causes you care about by allocating a lump sum or percentage of your estate to them in your will.

How to Choose Charities to Give to

Start by thinking about causes that are close to your heart and personal. Are there any charitable organizations that you or your loved ones have personally benefited from? Are there any that you have been involved with as a volunteer that you might wish to give to? Make a list of causes you believe in, and then do some research to find charities that focus on these causes. You may want to look into the reputation of any organization you are considering leaving money to. Once you have a shortlist of trusted charity organizations that reflect your own personal values, think about whether you would prefer to give a larger sum to just one, or if you would rather split the money between a few charities.

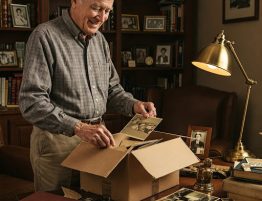

Adding a Charity to Your Will

Once you have decided which organization(s) you wish to give to, you will need to decide how much you would like to leave to them. You may choose a lump sum or a percentage of your estate. Work with a lawyer to draft the will and make sure that your wishes are laid out properly. This ensures that your will is properly drafted and safe from misinterpretation or contesting. Make sure to update your will as necessary as time goes on, for example if your financial situation changes significantly or if you decide to add another charity as a beneficiary.

Work with a Lawyer

The legal team at Munro & Crawford is here to help you create a will that leaves the legacy you want. Get in touch today, we are always happy to answer any questions you have and help you take the next step in estate planning.