A lot of estate-planning resources focus on providing security to spouses and children in the event of your death, but an estate plan is just as important for those who choose to remain unmarried and child free.

If you have no will as a single, child-free person, your assets will automatically go to your next of kin in the event of your death. This is usually your parents or siblings. Creating a will gives you control over exactly how your assets will be distributed and allows you to add the beneficiaries of your choice.

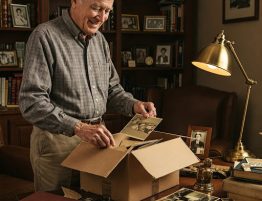

Choosing an Executor

You may choose a close friend, family member, or lawyer to be the executor of your estate. The most important thing to keep in mind is to appoint someone who is trustworthy and reliable, as the executor will be responsible for carrying out the wishes outlined in the will and managing the distribution of assets. You will also want to select an executor who has a good understanding of financial matters, as they may need to handle complex financial affairs, pay outstanding debts, and ensure the proper distribution of the estate.

If you choose a loved one or family member, it is crucial to discuss the role with them first and make sure that they fully understand and are comfortable with the responsibilities of an executor. Many people choose to appoint a lawyer to be co-executor or sole executor of their will in order to lessen the burden on their loved ones.

Choosing Beneficiaries

As an unmarried, child-free individual, you may have a sum of money that you would like to leave to a charity after you are gone. This can be a meaningful way of leaving a legacy that reflects your values and contributes to your community through education, healthcare, environmental conservation, social justice, or any other cause that is close to your heart. Do your research and choose a reputable charity (or charities) that speaks to you.

Providing for Your Pets

If you have pets, you can make sure that your will provides for them after you are gone. You can choose to leave your pets to a loved one or register them with a program that will find them a suitable home, such as the BC SPCA Survivor Care Program. You can also choose to set up a formal trust designed to financially support your pet’s care, or leave a lump sum of money intended for this use with the person who will be taking care of your pet after you pass away. For more information, see our guide to planning for pets in your will.

For assistance with preparing and updating your will, get in touch with the legal team at Munro & Crawford today. Our lawyers have extensive experience working with clients to create comprehensive estate plans.